PVTIME – Many of the major PV manufacturers released their performance for the first three quarters 2023, with impressive results. Most of them were benefit from the capacity expansion as well as keep their position in the market. Yet some of them had slow down the ram up plan in Q3 2023.

Why Chinese PV manufacturers slow down in Q3 2023

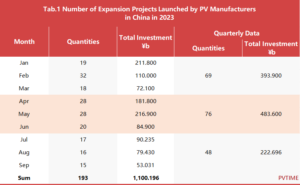

During the third quarter of 2023, there was a contraction in expansion activities of photovoltaic manufacturers based in China. The number of projects initiated and investments made decreased as compared to the first and second quarters of 2023.

The third quarter witnessed a decline of 30.43% in the number of manufacturing projects initiated, compared to the first quarter, and a further 36.84% decrease from the second quarter, indicating a downtrend. Furthermore, newly initiated projects in July 2023 numbered 17, declining to 16 in August and 15 in September, constituting the lowest point for the entire year. The quantity of expansion initiatives decreased by 53.125% from the pinnacle of 32 in February to 15 in September.

Investment in PV expansion decreased in Q3 2023, with the total amount invested in the expansion programme during the quarter being 222.7 billion yuan. This represents a decline of 43.46% from 393.9 billion yuan in Q1 and 53.95% from 483.6 billion yuan in Q2. The amount invested and number of expansions in Q3 were both on a downward trend. Total investment for July was 90.235 billion yuan, followed by 79.430 billion yuan in August, and 222.696 billion yuan in September. Specifically, the total investment in PV expansion in September saw a decline of 75.55% compared to the peak of 216.9 billion yuan in May 2023.

A manager of a PV company listed on the stock exchange suggested that Chinese solar manufacturers took caution regarding their Q3 expansion plans due to previous months’ overcapacity. The Q3 slowdown was mainly caused by the rapid growth of China’s photovoltaic industry, specifically in the manufacturing of silicon material, silicon wafers, cells and modules, resulted in greater supply than demand. Mr Zhong Baoshen, Chairman of LONGi, stated that the company was cautious about expanding its capacity due to the unconfirmed core products developed by various types of module and cell technologies in previous years.

Indeed, in Q3 2023, several leading photovoltaic companies not only exercised caution but also terminated fundraising and investment in new capacity.

Tongwei, a prominent firm engaged in the R&D, manufacturing, and marketing of core solar products, announced on 26th September 2023 that it terminated the issuance of shares worth 16 million yuan for a specific PV manufacturer project. Instead, the company planned to utilise its own funds, loans from financial institutions, and other available funds for the project that can be efficiently managed in terms of investment pace and production schedule.

Gokin Solar, a high-tech company specializing in researching, developing and producing large, high-efficiency photovoltaic silicon wafers, announced on 27 September 2023 that it intended to withdraw its initial public offering (IPO) of shares on the GEM of the Shenzhen Stock Exchange. The next day, the stock exchange institution declared that it had terminated the audit procedure for Gokin Solar’s IPO. According to documentation, Gokin Solar proposed to raise 5 billion yuan towards manufacturing schemes in Yibin City in Sichuan Province, China. These projects aimed to contribute to a production capacity of 5GW of monocrystalline silicon wafers and 25GW of monocrystalline silicon rods.

Similarly, Zhejiang Sunflower Great Health Limited Liability Company (SunFlower) (300111.SZ), a China-based company focused on investing in the pharmaceutical, healthcare, and high-tech industries, stated on 28 September 2023 that its subsidiary had chosen to halt the procurement of equipment for the high-efficiency solar cell production facility. The purchase agreement with Shenzhen S.C New Energy Technology Corporation (300724.SZ) was signed for 826.95 million yuan on 14 April 2023. It was stated that delays in launching the TOPCon project were primarily due to the slow payment of the facility’s lease fee and uncertainties resulting from a significant decline in PV market product prices.

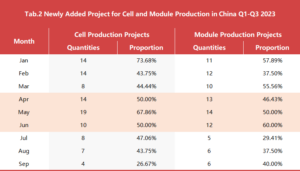

There was a decrease in the expansion of solar cell and module production during Q3 2023.

Both the volume and proportion of cell and module production experienced a decline in this period. The expansion data for solar cells and modules in Q3 was significantly lower than that of Q1 and Q2, as companies had focused on adding new capacity for solar cells and modules in the previous quarters.

Expansion projects for cells and modules during July, August, and September decreased gradually, with 8, 7, and 4 projects respectively. July’s figure was consistent with March’s, which marked a low point in both Q1 and Q2. August and September figures were 7 and 4 respectively, continuing the downward trend. In Q3, the percentages of newly added solar projects were 47.06%, 43.75%, and 26.67% respectively, indicating a persistent decline. Moreover, the September data indicates that photovoltaic companies were hesitant to expand their cell capacity and reduced investment in cell projects.

Consequently, the decrease in solar cell expansion projects led to a reduction in module expansion projects. In July, August and September, the industry recorded 5, 6, and 6 module expansion projects respectively, representing 29.41%, 37.50%, and 40.00% of the total expansion projects in the industry. The figures were lower than all of the data for the first and second quarters, with the month of July standing out as having the fewest number of projects during the nine months of 2023.

Slowing down but not stopping.

Despite some PV projects being halted in Q3 2023, others are still progressing. Since August and September, the initiatives set in motion by Tongwei, JinkoSolar, GCL, Trina, Chint/Astronergy and other major Chinese PV companies have continued.

Three projects were launched by Tongwei in the third quarter of 2023, including an industrial silicon manufacturing project and two projects to produce 16GW of silicon rods, wafers and cells in Leshan City, China. These projects, aimed at securing Tongwei’s supply chain and part of its integration plan, required an investment of 20 billion yuan.

On 7 August 2023, Chint/Astronergy declared its proposed expansion strategy that includes an investment of 22 billion yuan, consisting of 28GW capacity of solar cell production and 5GW capacity of module production. Its aim is to advance the productivity of its solar cell and module. Chint/Astronergy has been classified as one of the top 10 module suppliers in the world for several years, and its ambitious expansion of production can be comprehended given the recent competitive market scenario.

In recent years, JinkoSolar’s rapid development and production expansion have demonstrated the company’s comprehensive strength. In the first half of 2023, JinkoSolar has returned to the top of the module manufacturer with the largest shipment volume. On 14 August 2023, Jinko raised 9.7 billion yuan, solely intended to cover work capital and production expansion. The latter includes 28GW of silicon rods, 28GW of silicon slicing, as well as solar cells, modules and related products.

Another noteworthy development is that Seraphim signed agreements on 12 and 27 September, respectively, to invest in new 10GW and 15GW module production projects in various districts of Guangzhou City, China, with a total investment of 12 billion yuan.

In addition, the MingYang Group, a wind power firm that concentrates on the research and development of megawatt-scale wind turbines and primary components, entered the PV industry in May 2021 for further PV manufacturing expansion. On 13 September 2023, it entered into a project investment agreement to expand the heterojunction (HJT) cell and PV module capacity by 10GW, with a total investment of 10 billion yuan. MingYang began their PV business producing HJT technology, gradually expanding their capacity. This move confirms MingYang’s preference for HJT over other options, particularly as n-type technology replaces PERC products across the industry. Furthermore, according to their website, Ming Yang Smart Energy Group has mastery of HJT technology, as well as advanced perovskite technology and the latest generation of cadmium telluride thin-film PV technology.

In the third quarter of 2023, Trina Solar’s expansion into the United States differentiated it from competing manufacturers. On 11th September of the same year, Trina Solar declared that it will invest over $200 million in constructing a facility in the US, with an annual production capacity of 5GW for solar modules. Raw materials would be procured from suppliers in the United States and Europe. The facility is anticipated to become operational in 2024.

The enhanced capacity of solar cells and modules, coupled with the increasing demands of the PV sector, call for a rise in the production capacity of other components used in solar power systems. On 3 September 2023, Sichuan Shidi New Energy Co., Ltd. unveiled its intention to produce a substantial quantity of solar module connectors and junction boxes. The construction of the first phase of 100GW has commenced at Taizhou New Energy Industrial Park in Hailing District. An operational capacity of 60GW is anticipated by the end of 2024. After the project’s completion, the facility will have a cumulative planned capacity of 200GW of connectors and junction boxes, making it the world’s largest PV connector manufacturing base.

In the three months of the third quarter, both the number of expansion projects and the number and proportion of expansions in key segments such as solar cells and modules have shown a relatively sharp decline. Will the start of the fourth quarter and the general drop in temperature in China continue to affect the enthusiasm of companies to expand production to some extent?

The solar industry is predicted to continue its growth as many nations worldwide have set ambitious targets to decrease carbon emissions. The contributions of China and Chinese enterprises in reducing carbon emissions are highly significant. According to the International Energy Agency, the global photovoltaic manufacturing capacity is anticipated to almost double to 1TW by 2024, with China spearheading this expansion. Global photovoltaic manufacturing capacity is anticipated to double once more from 2023 to 2024, with China accounting for over 90% of the growth.

Should China’s top solar companies continue to expand their production to meet the current climate goals? If so, which products?

Recently, most of China’s top PV companies have achieved a stable position, and the strategies adopted by the leading ones might impact other firms as well as the entire industry. On 5 September 2023, Mr. Zhong Baoshen announced that LONGi is engaged in researching and developing BC products and technologies. The BC cell is projected to become the dominant product in the crystalline silicon cell market over the next 5-6 years. Current efforts towards double-sided and single-sided cell technology are leading to the development of BC products. Mr. Zhong Baoshen’s comments sparked lively debates within the industry regarding the future of solar cells, as the competition between TOPCon and HJT remains unresolved. Although there are varying opinions on the future of BC technology development, the preference of top manufacturer LONGi may impact other solar enterprises. Furthermore, increased capacity for BC products may lead to significant expansion in the future to replace older technologies and products.

The industry is advancing rapidly, although the issue of overcapacity could lead production enterprises to adopt a more cautious approach. In October, there was limited information available on PV expansion projects initiated by China’s PV companies. Expansion may continue in November, December, and 2024, but the direction and extent of production expansion are unclear. Therefore, caution may prevail for some time in the future.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES