PVTIME – In the global push for energy transition, solar photovoltaic technology is a crucial driving force, continuously innovating and propelling the industry forward. BC (Back Contact) technology, a rising star, has drawn significant attention in recent years due to its high performance and potential. Professor Martin Green from the University of New South Wales (UNSW) in Australia, renowned as the “Father of Photovoltaics”, provided his insights via video on the Back Contact (BC) Solar Technology Development White Paper jointly released by the China Electricity Council, TÜV Rheinland, China General Certification Center (CGC), AIKO, and LONGi on 27 April 2025. He predicted that Interdigitated Back Contact (IBC) technology would gradually replace TOPCon technology within the next five years. Meanwhile, he lauded the industrial progress of Chinese companies in BC applications and the vast future potential of this technology.

Company–specific BC Technology Developments in China

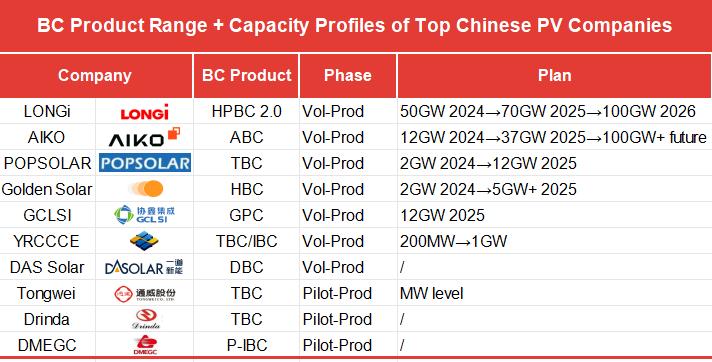

China has demonstrated remarkable prowess in BC technology. A multitude of companies are investing, researching, and mass-producing BC-related products, making headway on all fronts.

PV giant LONGi has rolled out its BC product portfolio based on Hybrid Passivated Back Contact (HPBC) technology, featuring the Hi-MO 9 and Hi-MO X10 modules. The Hi-MO 9, designed for centralized power plants, offers a power output ranging from 660-680W and achieves a module efficiency of 24.43%-24.8%. On the other hand, the Hi-MO X10, tailored for distributed applications, incorporates HPBC 2.0 and a 0BB structure. It attains a module efficiency of 24.8%, reduces hot-spot temperatures by 28%, and generates 9.1% more power than TOPCon modules. LONGi’s HPBC 3.0 pilot line is aiming for a conversion efficiency of 26%.

LONGi has had significant success in tenders. It won the 1.2GW BIPV tender in Qinghai Solar Plant with HPBC modules and another 300MW BC/HJT tender in China. Additionally, it secured over 5GW of Hi-MO9 module orders for PV projects in Europe, the Middle East, and China.

By 2025, LONGi’s BC cell production capacity will reach 70GW, with 50GW dedicated to HPBC 2.0. The company’s projections indicate a notable upward trend for BC modules in its product mix. BC modules are expected to account for 27% of shipments in 2026, rising to 35% in 2027, 48% in 2028, and reaching 62% in 2030. These figures illustrate LONGi’s clear strategy to expand BC product manufacturing to meet market demand and boost market share.

AIKO Solar has emerged as a significant player in the BC technology race with its ABC modules, which integrate n-type and BC technology. In 2021, AIKO Solar initiated mass production of its ABC products, including 10GW of silver-free metallised ABC cells and modules. In 2023, the company made further strides with the mass production of 15GW of high-bifaciality ABC modules. AIKO Solar operates a 10GW ABC factory in Zhuhai City, China, and another 15GW production line is under construction in Yiwu City.

In 2024, AIKO’s ABC module shipment volume was 10GW, and the target for 2025 is 15GW, with 60% destined for high-end overseas customers, particularly in the US and EU. AIKO Solar has set an ambitious production target for 2025, aiming to achieve product shipments exceeding 20GW. With potential future funding, the company plans to accelerate the construction of its Yiwu base. In the medium to long term, AIKO Solar is targeting a production capacity of over 100GW, signaling its intention to strengthen its global market position.

POPSOLAR‘s high-efficiency BC cells, with a gridless front side, offer several advantages that distinguish them in the industry. They consume less silver during BC cell processing, making them suitable for flexible, portable solar panels. POPSOLAR’s first manufacturing base in Jiangsu of China, has a capacity of 2GW and is already operational. A second base in Jiangmen, Guangdong, with a planned capacity of 10GW, is under construction. Once fully operational in 2025, POPSOLAR’s total annual capacity will reach 12GW. Given the growing demand for sustainable energy and ongoing technological advancements, POPSOLAR is well-positioned to further expand its BC production capacity in the future.

Golden Solar (Golden Solar New Energy Technology) built the world’s first mass-production line for heterojunction back-contact (HBC) cells in September 2023. This innovative line combines the intrinsic crystalline silicon passivation of traditional heterojunction with a tunneling passivation structure. Following the success of its first HBC cell line, Golden Solar swiftly planned to build new factories and increase production capacity to 5GW.

In 2024, Golden Solar formed a joint venture with LONGi to upgrade four PERC production lines at LONGi’s Xi’an Aerospace Industrial Base to high-efficiency HBC lines. On 29 April 2025, a subsidiary of Golden Solar signed an investment agreement with a subsidiary of JA Solar in Yiwu City. The partnership aimed to upgrade the production lines to produce 4GW of HBC solar cells annually, further strengthening Golden Solar’s market presence.

GCLSI (GCL System Integration Technology Co.) launched its GPC 2.0 high-efficiency modules in December 2024. Based on the TOPCon passivation technology platform, the GPC (Graphical Precise Doping Passivation Contact) cells power these 2382*1134mm modules to deliver 660W. With a mass-production efficiency of 27.1% and a first-year degradation rate capped at ≤0.4%, they are well-suited for commercial, industrial, and residential distributed solar installations.

For 2025, GCL has outlined plans to convert part of its TOPCon production lines to BC cell manufacturing, targeting an initial capacity of 12GW. Simultaneously, its R&D team is developing the GPC 3.0 version, aiming to increase efficiency beyond 27.4%. The introduction of silver-free metallisation and 0BB technology will help reduce costs. Notably, GCL reports that the non-silicon cost of its BC cells has already been reduced by 28% compared to conventional methods. This cost reduction positions BC cells to be price-competitive with TOPCon products, marking a significant milestone in the solar energy landscape.

YRCCCE (Yellow River Hydropower Project Construction), a subsidiary of SPIC, established China’s first mass-production line for n-type interdigitated back-contact (IBC) cells and modules. The mass-produced IBC cells had an average conversion efficiency of 23% and a production capacity of over 200MW.

In 2025, YRCCCE launched its proprietary new-generation n-type TBC cells and the Andromeda 3.0 series of high-efficiency TBC modules. Notably, the 72-cell white module (70% bifaciality) stood out with an efficiency of 24.2%. In February, YRCCCE received a 70MW order from European markets such as Switzerland and Spain. The order included 50MW of high-efficiency n-type TBC/IBC M6 products and 20MW of custom-made black single-glass IBC modules. With zero light-induced degradation and a conversion efficiency of over 24%, these products meet the requirements for stable long-term power generation in European residential environments. Additionally, YRCCCE has an expansion plan for a 1GW TBC cell factory, expected to be operational later this year.

DAS Solar‘s Diamond Series BC modules, known as DBC modules, reached a significant milestone in the fourth quarter of 2024 when they entered mass production. Although the specific production capacity of these DBC modules remains undisclosed, DAS Solar has continued to make its mark in the industry. In March 2025, the company showcased its Diamond BC modules at the prestigious Italian International Renewable Energy Exhibition. By effectively combining the benefits of TOPCon 4.0 and BC technology, the DBC modules achieved an impressively high photoelectric conversion efficiency of over 26.88%. This accomplishment not only showcases DAS Solar’s technical expertise but also solidifies the competitiveness of its DBC modules in the dynamic renewable energy market. However, no specific data on the capacity of ABC production are publicly available.

Tongwei is actively researching the BC technology route, with parallel efforts in both p-type and n-type BC development. Its p-type TBC has achieved an efficiency of 25.18%, while its n-type TBC has reached a peak efficiency of 26.11% in the laboratory. The company’s established research centre and TBC technology test line have further advanced the n-type TBC cell efficiency to 26.84%, with TBC modules exceeding 660W in power. As of April 2025, Tongwei’s TBC products have not entered mass production yet.

Drinda has set up an n-type BC product trial line at its R&D centre. Announced in 2023, the technology entered the pilot-testing phase with the aim of mass-producing n-type BC products. In 2025, the TBC cells in the pilot line demonstrated an efficiency increase of 1-1.5% compared to other mainstream n-type cells. Since BC cells currently lack a cost-performance advantage over TOPCon, Drinda is focusing on enhancing the cost-effectiveness of BC technology. Future mass production of TBC cells will depend on market-driven evaluation.

DMEGC established a BC pilot test line in 2022 and unveiled P-IBC products in 2023. However, yield rate issues prevented mass production. Continued R&D efforts led to DMEGC’s successful patent application for “BC solar cell and its electrode structure” in March 2025.

Despite the dominance of other leading Chinese photovoltaic companies in the TOPCon field and their current focus on this technology, research into BC technology continues unabated.

Jinko Solar has been actively engaged in BC technology R&D and has obtained related patents. The company is not only planning BC production capacity but is also set to announce that its BC products will be priced on par with TOPCon offerings. With a dedicated BC R&D pilot line already in place, Jinko is steadily increasing its investment in this area. At the same time, recognizing the significant efficiency-improvement potential of TOPCon, the company continues to invest heavily in this technology as well. Confident in its BC R&D lead, Jinko is currently evaluating future capacity-building strategies.

Trina Solar showcased its BC module products at an industry exhibition in 2024. Although no clear expansion plans have been publicly announced, given the strong growth potential of BC cell technology, Trina, as a major player in the photovoltaic sector, is likely to consider ramping up production in the future. Such decisions will be based on a careful assessment of market demand, technological advancements, and cost-effectiveness.

In March 2025, JA Solar announced that it had started to reallocate its R&D resources, gradually shifting its focus to BC and perovskite tandem technologies. As mentioned above, on 29 April 2025, its subsidiary signed an agreement with a subsidiary of Golden Solar to build a 4GW HBC factory in Yiwu City, China. This could be the fastest start to BC production from scratch, although its share in the joint venture remains unclear.

Market Outlook and Challenges

In the second half of 2025, the market direction of BC technology will depend mainly on downstream power plant validation. Manufacturing challenges such as performance improvements and production line maturity have largely been overcome. The key now is whether BC technology can meet customer requirements. If it does, especially with the support of industry-leading initiatives, BC order volumes could soar.

At present, most PV manufacturers are taking a cautious wait-and-see approach to BC technology. However, as demand grows, retooling of production lines and technology upgrades will become essential. The ease of replicating and scaling BC technology is an advantage, with the successes of LONGi and AIKO Solar in BC providing a viable model for other companies.

Despite an optimistic long-term outlook, the BC technology faces significant short-term challenges.

TOPCon’s substantial existing inventory and production capacity pose a direct threat to BC’s market share. Industry analysis shows that with a six-year depreciation schedule for solar cell and module equipment, TOPCon’s production costs include 0.04 yuan/W of equipment depreciation from 2022 to 2027. The ongoing capacity expansions of TOPCon 2.0, with depreciation spread over three years from 2025 to 2027, add another 0.02 yuan/W to the cost. By 2028, when these depreciation periods end, TOPCon’s production cost will fall by 0.06 yuan/W. In contrast, TBC, which only starts mass production in 2024, will incur equipment depreciation costs of 0.06 yuan/W from 2024 to 2029. This gives TOPCon a growing cost advantage, especially when combined with the efficiency gains expected from TOPCon 3.0, which could further erode BC’s market share by 2030.

The rise of perovskite technology is also looming large. The China Photovoltaic Industry Association forecasts that China’s new perovskite cell capacity will reach 161GW by 2030, with a market penetration of 30% and a market size of 80 billion yuan. Perovskite/crystalline silicon tandem technology will take market share from traditional silicon-based technologies, directly challenging BC’s market opportunity.

Scaling up BC production will require massive investment. The China Photovoltaic Industry Association forecasts global new PV installations of 881GW in 2030, requiring around 1050GW of solar cell manufacturing capacity. For BC to achieve its projected 62% market share in 2030, it would need 650GW of capacity, far more than the 50GW available at the end of 2024. Building the remaining 600GW at an estimated 400 million yuan per GW, including 300 million yuan for cell production and 100 million yuan for module production, would require a staggering 240 billion yuan in investment.

Uncertainties remain about who will fund this expansion and whether it is a prudent move. Large-scale investment in BC could disrupt the stability of the industry and potentially trigger another economic downturn in the sector if not carefully managed.

In essence, what the global new energy and environmental industries really want is a PV market that is both competitive and collaborative, and that develops in a healthy way.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES