PVTIME – The 2025 German elections are a pivotal event with far-reaching implications for the new energy industry. As a major economic and political power in Europe, Germany is at the forefront of the global energy transition. Its energy policies not only shape the domestic energy landscape, but also have a significant impact on the international new energy market, given the country’s role in the European Union and its extensive trade relations. This article aims to comprehensively analyse the impact of the 2025 German elections on the new energy industry from multiple perspectives, including domestic policies, market dynamics and global implications.

Policy shifts and their impact on the German new energy market between 2020 and 2025

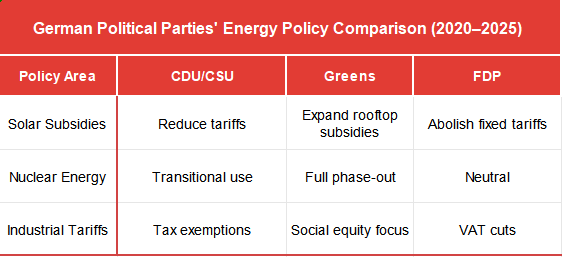

A. Energy Policies of Different Political Parties

The Christian Democratic Union/Christian Social Union (CDU/CSU) has advocated a market-driven expansion of solar and storage. In response to the falling cost of solar technology, they have reduced feed-in tariffs. For example, the feed – in tariff for ground-mounted PV was capped at €0.068/kWh in 2024. They supported the EU’s Net – Zero Industry Act, aimed at boosting domestic solar manufacturing. However, Germany’s heavy reliance on Chinese imports, with around 80% of solar components sourced from China, posed a challenge. This reliance on imports made the German solar industry vulnerable to supply chain disruptions and trade tensions. In addition, the CDU/CSU proposed to use nuclear power as a transitional source to ensure stable energy supply during the expansion of renewables. They rejected the Green Party’s 2023 nuclear phase-out plan and instead emphasised the need to balance the growth of renewables with the stability of the energy grid. To reduce industrial electricity prices, which will be 41.02 ct/kWh in 2024, they introduced tax exemptions and grid charge reductions. This was part of their strategy to improve the competitiveness of German industry in the global market.

The Green Party (Bündnis 90/Die Grünen) is committed to renewable energy. Their goal is to achieve 80% renewable electricity by 2030. To achieve this, they have accelerated subsidies for rooftop solar and grid-scale storage projects. They set a target of 24 GW of public storage by 2037. In 2022, they legislated for a complete phase-out of nuclear power, shifting the focus to wind and solar. This decision was based on their strong environmental stance and belief in the potential of renewables to meet Germany’s energy needs. However, her proposal to subsidise low-income households ran into fiscal constraints under the debt brake. This limitation highlighted the challenges of implementing a socially just energy policy in a fiscally constrained environment.

The Free Democratic Party (FDP) favoured a market-led transition. They opposed state subsidies and instead advocated tax incentives for private solar investment and deregulated energy markets. They criticised green levies for raising tariffs and proposed VAT exemptions for energy-intensive sectors. The FDP argued that a more market-oriented approach would encourage innovation and efficiency in the energy sector, allowing the market to allocate resources more effectively.

The Alternative for Germany (AfD) took an anti-renewable energy stance. They wanted to abolish the Renewable Energy Sources Act (EEG), bring back coal and abolish the eco-tax. Their position represented a significant departure from the mainstream of energy transition in Germany. However, their influence remained marginal and their policies did not gain significant traction in the political landscape.

B. Market Reactions to Policy Changes

The different energy policies of the various political parties led to significant fluctuations in the German PV market between 2020 and 2025. In 2023, solar capacity increases by 53%, driven by factors such as government incentives and growing interest in renewable energy. However, growth slows to 4% in 2024. This slowdown is mainly due to subsidy cuts and oversupply. The subsidy cuts advocated by the CDU/CSU and FDP have made solar projects less financially attractive to investors. The oversupply situation was the result of increased production capacity in the solar industry, both domestically and globally, leading to intense competition and downward pressure on prices.

Excess solar generation during the day led to frequent negative electricity prices, reaching as low as -€500/MWh. This phenomenon put immense pressure on the profitability of the PV industry. When electricity prices turn negative, solar power producers have to pay to export their electricity, which undermines the economics of solar projects. As a result, many German PV companies faced difficulties. Between 2023 and 2024, more than 20 SMEs went bankrupt due to price competition and policy changes such as subsidy cuts. In November 2024, Meyer Burger, a Swiss PV giant, closed its German factory in Saxony, laying off 500 workers. The company cited price competition from Chinese companies and insufficient policy support in Germany, and planned to move capacity to the US to take advantage of subsidies. In December 2024, Manz Group, a well-established German PV equipment manufacturer, filed for bankruptcy due to lagging technology iterations and declining market demand. In January 2025, Bosswerk GmbH & Co. KG, a German home energy storage company, filed for bankruptcy due to the PV price war and declining sales. These cases illustrate the harsh reality facing the German PV industry in the context of changing policy and market dynamics.

Uncertainties and Challenges in Germany

A. Uncertainties in Renewable Energy Development

The future of the renewable energy sector remains uncertain after Germany’s general election in 2025. A CDU-led coalition could slow the growth of rooftop solar by prioritising industrial tariffs over subsidies. This shift in focus could reduce incentives for homeowners and small investors to install rooftop solar. Storage projects may face funding gaps without government guarantees. Grid-scale storage is crucial for integrating renewables into the grid, as it can store excess energy generated during peak production periods and release it when demand is high or production is low. However, without government support, developers may find it difficult to secure the necessary financing for these projects.

In addition, the EU’s focus on high-efficiency technologies, such as HJT or BC cells, poses a technological challenge for German companies. These technologies require substantial investment in research and development. German companies may either have to invest heavily in innovation to keep up with technological trends or rely on imports, which could further impact the domestic manufacturing industry. The CDU’s push to extend the life of nuclear power plants could reduce the urgency of developing renewable energy. While nuclear power can provide stable baseload electricity, its use also raises concerns about nuclear waste disposal and safety. Extending the life of nuclear power plants could reduce the urgency of developing renewable energy sources, despite the long-term environmental benefits of renewables. This proposal also faces strong public opposition, reflecting the complex balance between energy security, environmental concerns and public opinion.

B. Tariff Volatility and Its Consequences

Market – driven pricing, as advocated by some political parties, may stabilise industrial costs but could discourage small – scale solar investment. In a market-driven pricing system, electricity prices are determined by supply and demand. While this can lead to more efficient pricing, it also introduces volatility. Small-scale solar investors, such as homeowners and small businesses, may be discouraged by the uncertainty of future electricity prices. They may be less likely to invest in solar installations if they cannot accurately predict the return on their investment. This could slow the growth of the distributed solar market, which has been an important part of Germany’s renewable energy expansion.

Implications for the European Energy Industry

A. Solar and Energy Storage

The German elections in 2025 have far-reaching implications for Europe’s energy industry, particularly for solar and energy storage. The EU’s target of 40% domestic PV production by 2030 is creating localisation pressures. This target aims to reduce the EU’s dependence on imported solar components and strengthen the domestic solar manufacturing industry. However, it could also fragment the supply chain. Currently, Europe relies on Chinese PV solar modules, with 60% of imports coming from China. The push for domestic production could lead to higher costs, estimated at 15-20% higher, as domestic production may not be as cost-competitive as imports from China. This could also disrupt existing supply chain relationships built up over years of international trade.

Although Germany’s 24GW storage target is driving regional demand, there are still funding gaps, particularly in Southern Europe. The development of energy storage projects requires significant capital investment. In southern European countries, which may have fewer financial resources than their northern counterparts, securing funding for storage projects can be a major challenge. The demand for residential storage in Europe has increased by 220% between 2021 and 2024, driven by falling battery costs and incentives for self-consumption. Companies such as Sonnen and Tesla are leading the way, while utilities are exploring virtual power plant models. Virtual power plants can aggregate the output of multiple distributed energy resources, including residential solar and storage, and optimise their operation to provide grid support services. However, widespread adoption of these models still faces regulatory and technical challenges.

B. Diverging Strategies among EU Countries

When it comes to nuclear energy and trade, EU countries have different strategies. France’s nuclear-centric model contrasts sharply with Germany’s focus on renewables. France has long relied on nuclear power, which accounts for a significant share of its electricity generation. Germany, on the other hand, is phasing out nuclear power and replacing it with renewables. These different approaches complicate the EU’s energy integration efforts. A unified energy policy within the EU is crucial to ensure energy security, reduce costs and meet the EU’s climate change targets. However, the divergence in nuclear and renewable energy policies makes it difficult to develop a common approach.

There is also a risk of escalating protectionism, such as anti-dumping measures against Chinese imports. Similar to the tensions over steel and solar in 2016, trade disputes could disrupt the global solar supply chain. EU regulations, such as the DPP and Ecodesign rules, are pushing companies to innovate in the area of sustainability. These regulations aim to improve the environmental performance of products and services. However, the compliance burden can stifle smaller players who may not have the resources to meet the strict requirements. Harmonised EU standards could help reduce market fragmentation. Standardisation can reduce barriers to trade and allow for more efficient competition in the EU market. Grid-scale storage is crucial for the integration of renewables, but financing mechanisms such as capacity markets still lag behind targets. Public-private partnerships, such as the Terna projects in Italy, offer a potential solution. These partnerships can leverage the strengths of both the public and private sectors to finance and develop grid-scale storage projects.

Influence on the Chinese PV Industry

A. Global Expansion of Chinese PV Companies

As a leader in the PV market, China is also significantly affected by the 2025 elections in Germany. In recent years, Chinese PV companies have been actively expanding globally. In 2024-2025, companies such as JinkoSolar, TCL Zhonghuan and Sungrow secured major contracts in Saudi Arabia and the UAE. These include a $985 million 10GW PV module project and a 7.8GWh storage system, the largest in the world at the time. At least ten Chinese solar manufacturers have announced plans to build factories in the Middle East by 2024, each targeting capacity in excess of 10GW. Energy storage companies such as CATL and Sunwoda are building battery plants in Turkey and Saudi Arabia. As a result, China’s solar exports to the Middle East will increase by 23.4% by 2024, with Saudi Arabia accounting for 43.1% of imports. This expansion into the Middle East market is part of China’s strategy to diversify its market share and reduce its dependence on the European market, which has become more challenging due to trade tensions and policy changes.

B. Challenges from German and EU Policies

However, the CDU’s alignment with the EU’s Net-Zero Industry Act poses tariff risks for Chinese companies. This legislation aims to boost domestic manufacturing in the EU by supporting domestic producers and potentially imposing tariffs on imported products. This threatens Chinese market share in Europe, forcing companies like LONGi to localise production. By localising production in the EU, Chinese companies can avoid tariffs and better adapt to local market needs. In addition, the EU’s circular economy standards, such as digital product passports, are putting pressure on Chinese companies to improve their recycling processes. These standards require products to be greener throughout their lifecycle, including at the end of their life. Chinese companies need to invest in research and development to meet these standards and ensure the long-term viability of their products in the European market.

In response, Chinese companies are making strategic changes. Sungrow, for example, is diversifying by targeting Middle Eastern markets, such as the Saudi 10GW project, to offset European risks. Chinese companies are also partnering with EU labs, such as the Cambridge-Suzhou collaboration, by investing in R&D to circumvent trade barriers. These partnerships can help Chinese companies gain access to advanced technologies and knowledge in the EU, while building relationships with local stakeholders.

Strategic Recommendations for the PV Industry

A. For European Firms

European PV companies can improve their competitiveness through several strategies. First, they should take advantage of the European Union’s €300 billion innovation fund. This fund provides a valuable opportunity to initiate projects related to agrivoltaics and smart grid integration. Agrivoltaics combines agriculture and solar power generation, maximising land use and promoting sustainable development. By integrating solar panels into agricultural landscapes, farmers can generate additional income from solar energy while continuing to grow crops or raise livestock. Smart grid projects can improve the efficiency and stability of the electricity grid, making solar energy more reliable. Smart grids can better manage the intermittent nature of solar power generation by using advanced sensors and control systems to balance supply and demand in real time.

Second, advocating for subsidy reform is crucial. European companies should lobby for a balanced policy that protects small and medium-sized enterprises (SMEs) in the PV industry. SMEs often bring innovative ideas and local market knowledge. They are also more flexible and can adapt quickly to changing market conditions. At the same time, these policies should ensure the global competitiveness of the PV industry as a whole. Without adequate protection for SMEs, the industry could lose its vitality and diversity. And without competitiveness, European PV companies may struggle to compete with their international counterparts.

B. For Chinese Firms

Chinese PV companies with a strong global presence need to adapt their strategies. One key approach is to localise production. Setting up joint ventures in EU countries such as Hungary and Spain can help them comply with local content rules, avoid trade barriers and reduce transport costs. It also allows for better integration into the local market. By having a local production base, Chinese companies can better understand local customer needs, build relationships with local suppliers and respond more quickly to market changes.

In addition, Chinese companies should focus on high-margin areas such as grid-scale storage and green hydrogen integration. Grid-scale storage can address the intermittent nature of solar power generation by storing excess electricity generated during the day for use at night or on cloudy days. This can make solar power more reliable and valuable. The integration of green hydrogen offers new business opportunities and markets. By using solar energy to produce green hydrogen through electrolysis, Chinese companies can explore new applications in the energy and transportation sectors, such as hydrogen-powered vehicles and energy storage. This can offset the impact of tariff pressures to some extent.

A number of high-profile Chinese PV companies are implementing these initiatives to adapt to international markets and promote the health of the solar industry.

C. Global Collaboration

Global cooperation is essential for the healthy development of the PV industry. Standardisation of certification is an important step. PV products have to meet different certification standards in different countries and regions, which often leads to trade friction. By aligning with international frameworks, such as the International Energy Agency’s (IEA) solar recycling guidelines, companies can reduce this friction. Standardised certification can also improve product quality, increase consumer confidence and promote global PV trade. It can also make it easier to compare different PV products on the global market, helping consumers and investors to make informed decisions.

This summer’s 2025 elections in Germany mark a critical turning point in the energy policy landscape. Balancing decarbonisation targets with industrial pragmatism is a complex task. For Germany, it requires careful consideration of the policy implications for the domestic market, including the future of renewable energy development, energy grid stability and industrial competitiveness. For Europe, it means balancing protectionism with cooperation to avoid disrupting the energy transition. A unified and cooperative approach within the EU is essential to meet the region’s climate goals and ensure energy security. For China, strategic adaptation through localisation and innovation is essential to maintain its global leadership in the PV industry.

The future of the PV industry requires well-designed policies that balance economic resilience with climate imperatives. As the world continues its transition to a low-carbon future, the new energy industry will play an increasingly important role. It is essential that all stakeholders, including governments, businesses and international organisations, work together to create a supportive environment for the development of the PV industry. This includes fostering innovation, ensuring a stable policy framework and strengthening international cooperation. In this way, we can not only meet the growing global demand for sustainable energy solutions, but also contribute to the long-term well-being of the planet and its people.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES