PVTIME – On January 20, CNNC Rich Energy Corporation Limited (hereinafter referred to as “CNNCNE”) announced the shortlisted bidders for its 2021 module tender. The bidding consisted of 11 packages for a combined capacity of 1.3GW.

According to the announcement, CNNCNE shortlisted Risen Energy as the first place bidder in 3 of 9 packages. LONGi was shortlisted as the first place bidder in 7 of 11 packages. Trina Solar was shortlisted for 8 packages, 1 of which as the first place bidder. Yingli was shortlisted for 4 packages, and Hu’nan Red Sun was shortlisted for 1 project. However, neither company received first place bids.

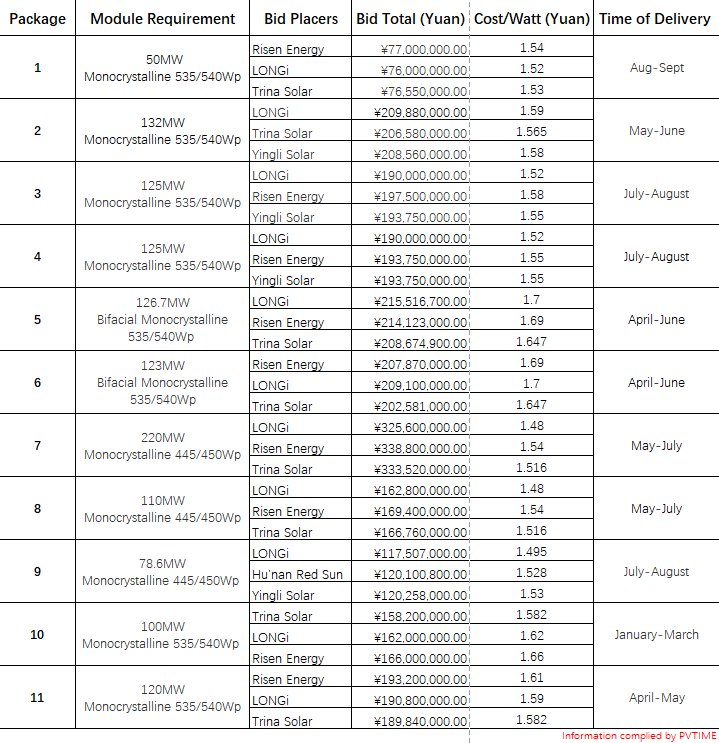

Bid information for CNNCNE’s 2021 module tender

Judging by the output requirements on the modules, CNNCNE is looking to mainly deploy large-sized modules in 2021. Among the 11 packages, 8 packages require 182mm modules for a combined capacity of 901.7MW, accounting for 69.4% of the total tender. 3 packages require 166mm modules for a combined capacity of 408.6MW, accounting for 30.6% of the total tender.

Modules with large-sized cells may be popularized in 2021 as their relatively lower LCOE becomes recognized by the industry. Many experts are predicting an increase in the market penetration rate for modules with large-sized cells in 2021. According to estimates, 182mm+ modules will be standing toe to toe with 166mm modules as the installed capacity split for 166mm, 182mm, and 210mm modules is estimated to be 45%, 20%, and 25%, respectively.

From a cost per watt perspective, packages that are set to be delivered in the first half of the year have higher costs than those set for delivery in the second half. The average price of package 2 is 1.578 yuan/W, the average price of package 5 is 1.678 yuan/W, the average price of package 6 is 1.689 yuan/W, the average price of package 10 is 1.621 yuan/W, and the average price of package 11 is 1.594 yuan/W. The higher average cost of packages 5 and 6 are likely related to the required modules being bifacial.

The latest data from PVInfoLink shows that the highest price of 182mm monocrystalline monofacial modules is 1.73 yuan/W, the lowest price is 1.62 yuan/W, and the average price is 1.68 yuan/W. For 210mm monocrystalline monofacial modules, the highest price is 1.73 yuan/W, the lowest price is 1.63 yuan/W, and the average price is 1.68 yuan/W. For large-sized modules set to be delivered in the first half of the year, PVInfoLink predicts the cost to be between 1.66-1.7 yuan / W. It is important to note that the specific price still will vary depending on the capacity of the project and the specific delivery date.

Using this price as a standard, CNNCNE’s shortlisted bids are actually lower than the market price, especially for the second half of the year. This trend is also in line with expert predictions of the market price of modules declining in 2021.

Regarding how low module prices will fall in 2021, Sinolink Securities predicts that the price of photovoltaic modules may fall to 1.5-1.55 yuan/W, while some believe that the price of 1.40 yuan/W is also a possibility in the second half of 2021.