PVTIME – Demand for solar energy is soaring worldwide. And solar cells with higher power conversion efficiencies and lower costs than mainstream cells are expected. The solar industry is being driven by materials and technology innovation, and the spotlight is shining on perovskite solar technology, attracting a growing number of manufacturers and investors, and taking perovskite solar cells from the laboratory to the marketplace as the industry is backed by ambitious zero-carbon government targets.

In just ten years, perovskite technology has achieved what took crystalline silicon cells 50 years to develop. In 2009, Japanese scientist Tsutomu Miyasaka achieved a significant milestone in the field of renewable energy by generating electricity for the first time using a perovskite photovoltaic cell, which at the time had a power conversion efficiency of 3.8%. Just a decade later, in 2019, the conversion efficiency of perovskite solar cells had risen to 25%.

At present, perovskite solar cells have a conversion efficiency that is superior to that of crystalline silicon cells. The theoretical efficiency limit of crystalline silicon solar cells is 29.43%. The maximum efficiency achievable under ideal conditions for ordinary monocrystalline silicon cells is 24.5%. HJT cells have a maximum efficiency of 27.5% under ideal conditions, while TOPCon cells have a higher efficiency limit of between 28.2% and 28.7%. It is important to highlight that perovskite cells offer a significantly higher conversion efficiency than crystalline silicon cells. The theoretical conversion limit of a single-layer perovskite cell is up to 31%, while silicon and perovskite tandem cells can reach up to 35%. A three-layer tandem cell has the potential to achieve 45%. There is considerable scope for further improvement. By doping new materials with current ones, the conversion efficiency of perovskite cells could reach an impressive 50%. This would represent a doubling of the current efficiency of crystalline silicon cells, which would be a significant achievement.

It is clear that perovskite technology is a major attraction for manufacturers and investors, despite the fact that these data are still in the laboratory or on paper. A new market landscape is emerging, and it is crucial for PV players to maintain a leading position in the market to avoid being left behind by other producers.

It is crucial to develop all laboratory results, given the very small sizes of these cells (typically between 1 cm² and 1.12 cm²) and the limited lifespan, which is insufficient for industrialisation. Those solar cell producers aiming to bring perovskite products to market will require significant investment to enhance conversion efficiency, lifespan and enlarge cell size.

In China, the first photovoltaic company to undertake large-scale perovskite production is GCL Perovskite (Kunshan GCL Photoelectric Materials Co., Ltd.), a subsidiary of GCL Tech. Production commenced in 2021 with a pilot line capable of 100MW. In March 2024, the company achieved a conversion efficiency of 19.4% on its 1,000mm x 2,000mm single-junction perovskite solar module, as officially tested by the China National Institute of Metrology.

Two years ago, there were nine perovskite cell or module producers in China, acting as pioneers in research and development and pilot line construction. These include GCL Perovskite and Microquanta Semiconductor, which have completed six rounds of financing respectively. These companies have attracted investment from a number of prominent sources, including Tencent, Temasek, Sequoia China, IDG Capital, CATL and others. Moreover, a number of new Chinese perovskite companies, including UtmoLight, Renshine Solar, Photon Crystal Energy, and others, have secured substantial financing, amounting to hundreds of millions.

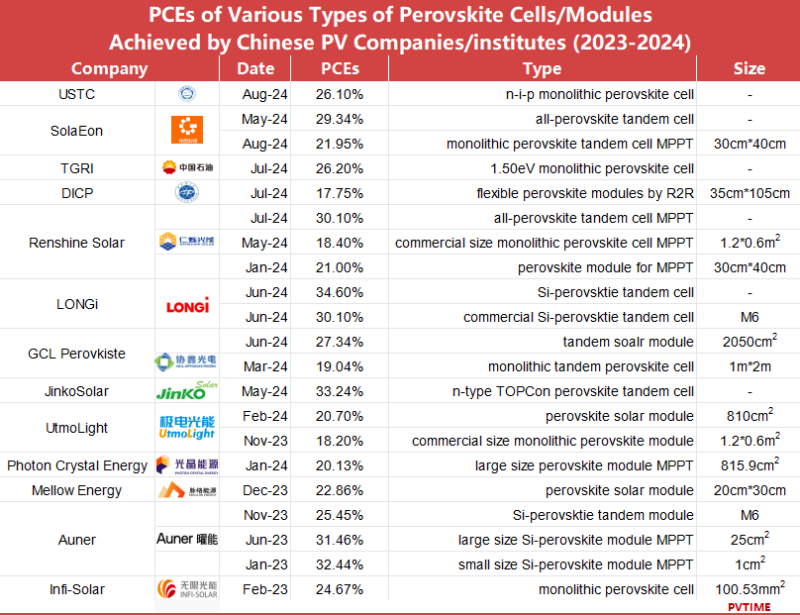

This is a significant boost for the industry. Investors have made a substantial investment in perovskite technology. Since 2024, at least ten photovoltaic companies have secured investment. The majority of these producers are new businesses that have received initial financing. The majority of the funds were allocated to the construction of MW-level pilot lines, as well as technology innovation and R&D upgrades. Significant advances are also being made in perovskite solar cells and modules.

These financial incentives are facilitating the transition of perovskite solar products from laboratory to market. At least five Chinese perovskite companies are currently operating production lines at 100 megawatts, including GCL Perovskite, Microquanta Semiconductor, Renshine Solar, Microquanta and Wonder Solar. The first four companies have adopted monolithic perovskite cell technology, which is considered the fastest technology to be industrialised. With the backing of financial and technological resources, GCL Perovskite has achieved a power conversion efficiency of 19.04% for its perovskite cell with a large size of 1m*2m, generated from its 100MW production line. UtmoLight, Renshine Solar and Microquanta are manufacturing perovskite products with dimensions of 1.2m*0.6m. The former two have exceeded a conversion efficiency of 18%. In fact, the power generation volume of perovskite products with PCE above 18% and a lifespan of 15 years is comparable to that of crystalline silicon modules.

In November 2023, the world’s first commercial perovskite PV power plant was connected to the grid and became fully operational in Inner Mongolia, China. The plant was launched by China Three Gorges Renewables (Group) Co., Ltd. and utilises 11,200 perovskite modules provided by Microquanta, with an installed capacity of 1 MW. It forms part of a 2GW commercial solar power plant located in a desert area with challenging environmental conditions. Further data and analysis will be collected to assess the suitability of perovskite modules in a range of scenarios.

In addition to its high conversion efficiency, another key benefit of the perovskite cell is its excellent performance in low-light environments. By modifying the chemical composition of the perovskite material, it is possible to alter the wavelength of light that it absorbs. By tuning the perovskite layers to different wavelengths, they can be stacked together or on top of crystalline silicon solar cells to absorb light across a wide spectrum. The power conversion efficiency will remain high even in cloudy and rainy conditions.

As a third-generation solar cell, the low cost of perovskite cell production is a significant advantage, in addition to the outstanding conversion rate. The raw materials are inexpensive and readily available, and the processing time is minimal. A research report released by Donghai Securities estimates the investment for a pilot line of perovskite products with a capacity of 100MW to be between 70 million yuan and 80 million yuan. In terms of mass production, the estimated investment in production lines with a capacity of one gigawatt is 500 million yuan, while the cost of a perovskite module is expected to be 0.5 to 0.6 yuan per watt.

There is a strong expectation that perovskite solar products will be adopted in a wide range of application scenarios.

Based on current technology and solar products, there are two main scenarios for solar power systems, as follows: The first is a distributed or centralised solar power generation system, while the second is a building-integrated photovoltaic power system.

The building-integrated photovoltaic (BIPV) is an emerging application scenario in the PV industry that is currently experiencing a period of rapid growth. The IEA-PVPS forecast indicates that the European BIPV market will grow by approximately 200MW to 300MW per year, while the global market is expected to expand by 1GW annually. The potential for renovating existing buildings in China is estimated at 10 billion square metres, with an additional 120 million square metres of BIPV capacity per year. The 14th Five-Year Plan of China sets an objective of reaching an installed capacity of 50GW for PV systems on new buildings by 2025, representing 8% of the renewable energy in urban buildings. Given the demand for BIPV in existing building renovation and new buildings in China, the market is estimated to be worth more than one trillion yuan in the conservative scenario.

Perovskite solar cells and modules are considered the optimal solution for BIPV. Currently, the majority of solar cells on the market are of the crystalline silicon variety. However, this type of cell has the disadvantage of being slightly thicker and heavier than other options, which makes it unsuitable for BIPV systems. The average weight of crystalline silicon cells is approximately 10 to 15 kg per square metre, making them suitable for installation on rooftops with higher strength. While perovskite cells weigh approximately one-tenth of crystalline silicon cells, this is due to their utilisation of a thin film structure comprising iodine, lead and other crystals to absorb sunlight and generate electricity. The thin and lightweight structure of perovskite cells allows them to be installed on the walls of buildings with good light transmission, eliminating any negative aesthetic effects. Furthermore, the power generation rate of crystalline silicon cells is significantly influenced by the angle of light, whereas perovskite cells remain unaffected. This makes them an ideal solution for indoor light harvesting, offering a convenient and efficient source of energy.

In addition to the glass wall application, perovskite cells are also expected to be applied in wearable PV, vehicles, as well as large-scale PV systems such as agriculture and ground power stations. To achieve these goals, there is a need for technological breakthroughs, broad market prospects and financial and policy support. In light of these developments, numerous solar module producers have announced their intention to expand production.

In China, several of the perovskite industry’s trailblazers have commenced production at the GW level.

GCL Perovskite has announced that its mass production lines for perovskite products will reach GW-level capacity by the end of 2024. Additionally, the company plans to gradually increase its production capacity of commercial perovskite products with conversion efficiency of more than 27%.

In June 2024, Microquanta, a leading provider of perovskite photovoltaic technology, manufacturing and application of perovskite modules for utility-scale solar farms and BIPV, announced that the first phase of its large-scale perovskite solar manufacturing base has been approved by the local government. The initial phase of the project will have an output of 1GW of solar cells and modules per year in Quzhou City, China. The facility is scheduled to commence operations in the second quarter of 2025. The new production lines are expected to reduce the overall cost of production and provide customers with highly efficient and reliable perovskite solar products.

In May 2024, Renshine Solar, a developer of perovskite solar cells, entered into a cooperation agreement with the local government of Changshu City, Jiangsu Province, China. The agreement outlines the construction of a large-scale perovskite solar cell production base with the goal of achieving mass production of 1.2m*0.6m perovskite modules with 20% efficiency. The project will encompass research, development and production of GW-scale perovskite solar cells, with a total investment of 1 billion yuan. The estimated output value is 2 billion yuan per year.

In March 2024, Wuxi UtmoLight Technology Co., Ltd. (UtmoLight), a China-based leading technology development company for perovskite photoelectric industrialisation, announced that its perovskite mass production lines at the GW-level will be completed within 2024.

In January 2024, HIKING PV and investment companies entered into a production agreement for a facility focused on the manufacture of perovskite and silicon tandem solar cells and modules. The project is to be located in Zhongshan City, Guangzhou Province, China, with an anticipated production capacity of 7GW of high-efficiency perovskite and silicon tandem solar cells and modules per year.

Furthermore, ACME Optoelectronics, a leading high-tech company specialising in the production and sale of equipment for perovskite cell and module manufacturing, announced in August 2024 that it had successfully completed a nearly 100 million yuan angel round of financing. The funds will be primarily allocated to expanding the R&D team, promoting technological innovation and further upgrading the turnkey solution for MW or GW scale perovskite mass production. ACME Optoelectronics has extensive experience in the manufacturing and delivery of the first 600×1200mm pilot line and 1200×1300mm mass production line of perovskite modules in China. It provides complete production lines for perovskite processing, developed in-house, in a range of sizes, including 300×300mm, 600×1200mm and 1200×2400mm. Furthermore, the company offers customised design services for related equipment, including PVD magnetron sputtering, PVD thermal evaporation coating, slit coating, vacuum crystallisation, laser scribing, edge clearing and more.

In August 2024, Wang Bohua, Honorary Chairman of CPIA, commented at a summit focused on HJT and perovskite technology that the mass production of solar cells and modules based on perovskite technology will soon see a breakthrough. While perovskite cell technology currently faces challenges such as improving stability and reducing efficiency loss in large areas, these issues will be effectively addressed. The technology will undoubtedly offer unlimited opportunities, provided that it continues to benefit from innovation and support from finance and policy. Mr Wang expressed confidence in the future of perovskite solar cell technology, stating that it will usher in a new era for the PV industry and drive further energy transformation globally.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES