-Over $1.4 billion was raised through securitization in Q1 2021

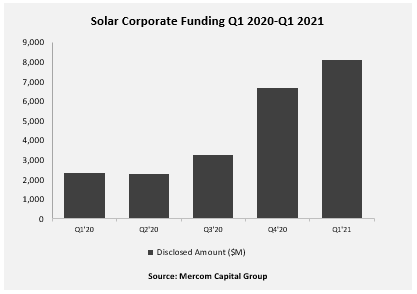

Mercom – Total corporate funding, including venture capital funding, public market, and debt financing into the solar sector in Q1 2021, came to $8.1 billion in 36 deals, a 21% increase compared to $6.7 billion raised in 43 deals in Q4 2020.

The increase in corporate funding was primarily due to higher debt and public market financing activity in the first quarter of 2021.

To learn more about Mercom’s Q1 2021 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/q1-2021-solar-funding-ma-report/

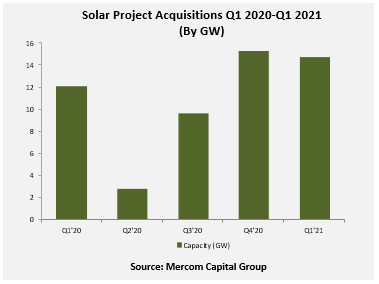

“Financing activity in the solar sector started strong in 2021 with Q1 numbers up substantially year-over-year. Even though solar stocks lost some of their spark in the first quarter after an unprecedented run in 2020, a big IPO and record securitization activity lifted overall fundraising totals. Solar assets continue to be in great demand with almost 15 GW of projects acquired in Q1,” said Raj Prabhu, CEO of Mercom Capital Group.

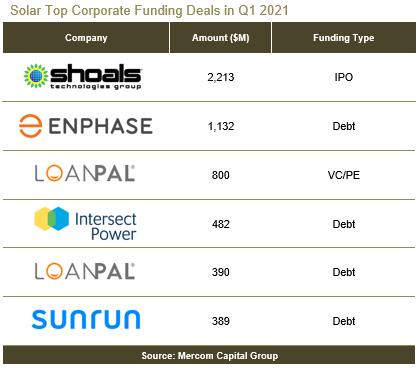

The top corporate funded deals in Q1 2021 were the $2.2 billion raised by Shoals Technologies Group through an IPO; the $1.1 billion raised by Enphase Energy, Loanpal’s $800 million raise; Intersect Power’s $482 million raise; Loanpal’s $390 million securitization deal, and Sunrun’s $389 million raise.

Global VC funding for the solar sector in Q1 2021 came to $1 billion in 14 deals, a 33% increase compared to $773 million raised in 12 deals in Q4 2020.

Of the $1 billion in VC funding raised in 14 deals during Q1 2021, 96% went to solar downstream companies with $990 million in 10 deals. In Q4 2020, solar downstream companies raised $748 million in six deals (97% of total VC funding raised).

The top VC/PE funded companies in Q1 2021 were: Loanpal which raised $800 million; Intersect Power which brought in $127 million, Daystar which raised $38 million; and $20 million raised by Tigo Energy.

A total of 43 VC investors participated in Q1 2021 compared to 47 investors in Q4 2020.

Public market financing in the solar sector dropped slightly, with $2.8 billion raised in eight deals in Q1 2021, a 7% decrease compared to $3 billion raised in 17 deals in Q4 2020. There were two IPOs announced this quarter.

Announced debt financing in Q1 2021 jumped to $4.3 billion in 14 deals, a 48% increase compared to Q4 2020, when $2.9 billion was raised in 14 deals.

Five securitization deals totaling $1.4 billion were recorded in Q1 2021, which was the largest amount of financing through securitization since 2013.

There were 20 solar M&A transactions in Q1 2021 compared to 12 deals in Q1 2020. Of the 20 solar M&A transactions announced in Q1 2021, 15 involved Solar Downstream companies, followed by three Balance of System (BOS) companies.

There were 82 large-scale solar project acquisitions (nine disclosed for $854 million) in Q1 2021, compared to 83 transactions (15 disclosed for $2 billion) in Q4 2020. Acquired projects totaled 14.6 GW in Q1 2021 compared to 15.2 GW in Q4 2020.

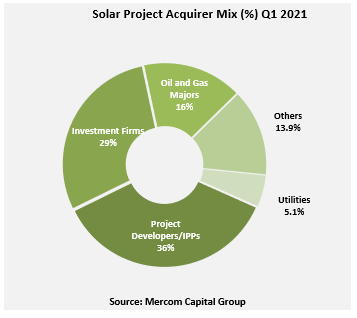

Project Developers and Independent Power Producers were the most active acquirers in Q1 2021, with 5.2 GW, followed by Investment Firms and Funds, which acquired 4.2 GW.

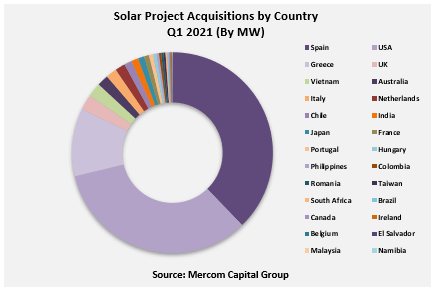

In Q1 2021, solar project acquisitions were spread across 26 countries. Spain led in terms of recorded acquisitions with 5.5 GW, followed by the United States with 4.8 GW and Greece with 1.6 GW of acquisitions. The top acquisition in the quarter was by Total, an oil and gas major, which acquired a development pipeline of 2.2 GW of solar projects in Texas from SunChase Power and MAP RE/ES.

Three hundred and fourty companies and investors are covered in this 91-page report, which contains 73 charts, graphs, and tables.

To learn more about Mercom’s Q1 2021 Solar Funding and M&A Report, visit: https://mercomcapital.com/product/q1-2021-solar-funding-ma-report/