PVTIME – The demand for solar energy is soaring worldwide. And solar cells with higher power conversion efficiencies and lower costs than the mainstrean ones such as PERC, HJT and TOPCon are expected. The perovskite solar cells have become a major attraction for PV manufacturers and investors, driving perovskite solar cells from the laboratory to the market as the industry is backed by governments’ ambitious zero carbon targets.

The perovskite solar cells are not new, it was introduced by Tsutomu Miyasaka in Japan in 2009 with a power conversion efficiency of 3.8%, and “hibernated” for almost a decade, as the power efficiency is a key factor for commercial solar cells. However, in recent years, the power conversion efficiency of single-junction perovskite solar cell reached 25.5% in 2020 and 33.2% for perovskite-silicon tandem solar cell in 2023 at the Photovoltaics Laboratory of King Abdullah University of Science and Technology (KAUST), which are still within reach of the radiation limit defined by Shockley-Queisser (SQ) theory, making perovskite cells extremely promising as the third generation solar cell while other cells are reaching their limits.

The pros and cons of perovskites for solar cells

Perovskite refers to a family of compounds rather than a specific material such as silicon or calcium, and is named for its structural similarity to a mineral called perovskite, named after L.A. Perovski, a Russian mineralogist. Perovskite materials can work well with imperfections and impurities because they tolerate defects in the crystallographic structure, whereas silicon materials require extremely high purity to work well in electronic devices.

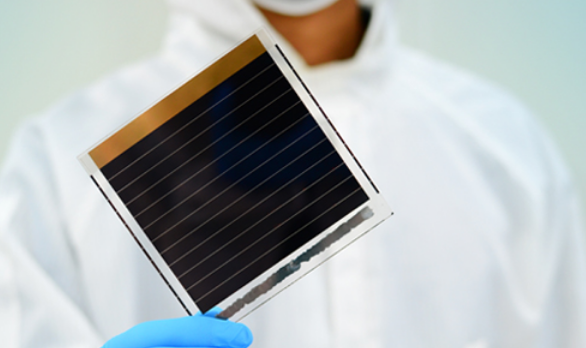

And when the perovskites are used for solar cells, the versatile optoelectronic properties and unique structure allow the photons of light harvested from the sun to be converted into electricity much more effectively than in cells using silicon materials. The thin film of perovskite can be applied to flexible substrates, offering the potential for different shapes of modules or panels. In addition, perovskite cells are easier to make in the laboratory than silicon cells because the chemical components of perovskite are easy to assemble.

However, the perovskites degrade much faster than the silicon material, which can operate for more than 25 years with at least 90% of the power output remaining. The short durability of perovskite materials has prevented them from being produced commercially in the last decade.

Chinese PV manufacturers and investors keen on perovskite

As perovskites show great promise, and the equipment and technology have been improved, several companies have started some commercial production in recent years, and Chinese investors put attention to commercialising them in 2020 due to the fantastic properties of perovskites, including high absorption coefficients, bandgap tunability, excellent charge-carrier mobilities and solution processability.

Some of the major PV players in China started their pilot-scale perovskite cell production lines in 2020 or 2021, with investments from institutions and investors such as Three Gorges Capital Holdings, Cathay Capital, Hillhouse Capital Group, Tencent, Gountry Garden, etc., to promote the further optimisation of perovskite cell production in materials, equipment and processes.

Since then, the industrialisation of perovskite cells in China has been greatly accelerated. In 2022, a 150MW perovskite cell production line was put into operation by UtmoLight, the solar business unit of SVOLT Energy Technology Co, Ltd. of Great Wall Holdings, and a 100MW production line by Hanzhou Microquanta, a China-based high-tech company focusing on R&D of perovskite solar cells and modules, while many pilot-scale production lines with production capacity of more than 100MW have been built by Chinese perovskite pioneers, including GCL Perovskite, Hangzhou Zhongneng Photoelectricity Technology, Hubei Wonder Solar LLC., and larger production lines are under plan.

The low cost of perovskite cell production is one of the key factors for Chinese solar cell manufacturers to get involved. The investment required for 1GW of crystalline silicon production capacity, wafers, cells and modules is around 900 million to 1 billion yuan. According to public data from Hanzhou Microquanta, GCL and Oxford PV, perovskite cell manufacturers in China and Germany, the demand for 1GW of perovskite products is around 500 million yuan, which is half the cost of silicon. And 500 million yuan is even 1/10th of the cost of 1GW of second-generation GaAs thin-film solar cells.

Meanwhile, the facilities required to produce solar cells are very different for perovskite and crystalline silicon cells. Mainstream crystalline silicon solar cells are processed in four different workshops from silicon materials to wafers, cells and modules, a process that takes at least three days. However, the core equipment for perovskites can be assembled in one production line, including PVD equipment, laser equipment, laminating equipment, cleaning, drying and various types of automation equipment, allowing glass, adhesive film, targets and chemicals to be processed into modules in one factory in 45 minutes, dramatically shortening the process and reducing costs.

In addition, the higher power conversion efficiency of perovskite cells compared to silicon cells is also attractive to manufacturers. The theoretical limit efficiency of single crystalline silicon cell is around 29%, which is currently within reach, 26.4% has been achieved by JinkoSolar with its 182 TOPCon cell, 26.56% by LONGi’s p-type HJT cell and 26.09% by LONGi’s indium-free HJT cell, 24% for IBC cells. The power conversion efficiency of single-junction perovskite solar cells is estimated to reach 31%, and that of tandem solar cells can theoretically exceed 45%.

100MW+ perovskite cell production lines in China

UtmoLight has completed distributed solar systems with its perovskite products in the Taihu Lake PV fencing pilot project in Wuxi City and two PV rooftop carport projects in Shanghai City, China. The perovskite products are suitable for various scenarios and are expected to be used in BIPV, distributed PV and all types of PV projects, UtmoLight said. What is more, on 12 April 2023, UtmoLight launched a perovskite production base, including the first production line with a production capacity of 1GW of perovskite cells, which will be completed by the end of 2024.

GCL Perovskite, a subsidiary of GCL Group the leading PV manufacturer, announced on 17 April 2023 that the power conversion efficiency of its 2m*1m large perovskite module has reached 16.02%, which will be increased to 18% during 2023, and that a GW-scale production line for perovskite cells will be launched in 2024.

In May 2022, Hanzhou Microquanta officially delivered 5,000 perovskite αmodules. And a number of demonstration projects using its perovskite αmodules have since been completed, including rooftop distributed PV systems, ground-mounted distributed PV systems and PV projects for transportation systems.

Renshine Solar, a China-based company that currently operates a 10MW perovskite cell production line and in January 2023 announced a steady-state power conversion efficiency of 29.0% for all-perovskite tandem solar cells, which is expected to exceed 30% within 2023, also stated that it will complete the construction of the 150MW perovskite production line in Q3 2023 and start mass production of the 1.2m*0.6m module by the end of Q4 2023. In 2024, it will upgrade the project to 150MW of multi-layer perovskite products and gear for the GW-scale perovskite production line.

The outlook for perovskite production in China

According to some Chinese industrial research institutes, the market share of perovskite cells in China was less than 1% in 2022 and is expected to rise to 30% by 2030. The scale of pilot line expansion for the perovskite cells may reach 1,000 to 1,200 MW in China in 2023, almost tripling from 350 MW in 2022. The total production capacity of perovskite cells in China is expected to exceed 25 GW in 2026, and the output value of the perovskite cell manufacturing and equipment industries is expected to exceed 40 billion yuan and 10 billion yuan, respectively, in 2026. Some institutions are more optimistic, predicting that the market value of perovskite cell equipment in China will reach 83.6 billion yuan by 2030.

The production capacity in China is impressive, will the commercialisation of GW-scale perovskite production be ahead of time?

It won’t be, and it’s unnecessary to be ahead of schedule, some Chinese experts believe that a healthy industry must follow the law of its own development, according to its technical improvement and downstream demand, rather than expanding without sufficient support in experience or technology. Meanwhile, it is crucial for perovskite PV product manufacturers to optimise processing in 100MW pilot lines in 2 or 3 years, as experience and upgraded equipment are important for the future construction of GW-scale perovskite production lines.