-TZS Strategic Investment in Maxeon at Greater Than $1 Billion Valuation

-Repositions SunPower as U.S. Downstream Pure-Play Solar Company

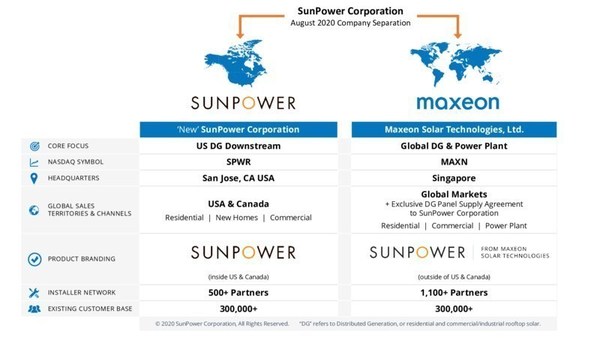

PVTIME – SunPower (NASDAQ:SPWR) and Maxeon Solar Technologies (NASDAQ:MAXN) today announced that they completed the strategic transaction announced last November, separating into two independent public companies. Each will now focus on their critical success factors for their respective business models.

“Now is the right time for this strategic spin-off, allowing both SunPower and Maxeon to invest in key programs to drive their future profitable growth,” said Tom Werner, SunPower CEO and chairman of the board. “Solar power is poised for significant growth and now each company is well-positioned to succeed based on specific areas of specialization, technology innovation and economies of scale.”

Tom Werner continues as CEO and chairman of the board of SunPower, headquartered in California’s Silicon Valley, with an employee and economic investment footprint across the U.S. and Canada. It also has an exclusive U.S. dealer network, the largest domestic residential and light commercial franchise. The company’s Hillsboro, Ore. manufacturing facility will remain part of SunPower.

“The new SunPower will further develop as the leading North American distributed generation (DG), storage and energy services company with an end-to-end software platform, differentiated products and solutions and an asset-light approach,” added Werner. “And I also want to thank our majority shareholder Total, strongly engaged in low carbon electricity, for its continued support since 2011.”

Maxeon is a global solar innovation leader with a strong channel to market that includes a worldwide network of more than 1,100 authorized sales and installation partners, and a strategy to move beyond the roof into adjacent DG products outside of the U.S. and Canada. Jeff Waters is CEO of Maxeon, headquartered in Singapore with panel and cell manufacturing facilities located in France, Malaysia, Mexico and the Philippines. Concurrent with this transaction is an equity investment of $298 million into Maxeon by long-time partner Tianjin Zhonghuan Semiconductor Co., Ltd. (TZS), a premier global supplier of silicon wafers. The TZS investment facilitates scale–up Maxeon production capacity of the newest generation of its Maxeon product family.

“We are prepared to start our first day as Maxeon, with industry-leading technology, a strong brand, a unique global sales channel and strong investment partners,” said Jeff Waters, CEO of Maxeon. “TZS has been a proven, long-time strategic partner of SunPower’s, cooperating on seven joint ventures and joint development projects since 2012. We are excited to have TZS’s backing at this important juncture in the emergence of solar power as a mainstream energy source.”

Maxeon and SunPower are cooperating to develop and commercialize next generation solar panel technologies, with early stage research conducted by SunPower’s Silicon Valley-based research and development group, and deployment-focused innovation and scale-up carried out by Maxeon.

“The creation of two separate public companies, that Total has fully supported as the majority shareholder, is a strategic milestone in SunPower’s development and in our decade-long partnership,” said Patrick Pouyanne, Chairman of the board and CEO of Total. “I want to offer my congratulations on the successful transaction and express my support to the teams whose remarkable efforts allowed us to make this operation a success. This will enable both companies to fully leverage their strengths on focused businesses: distributed generation marketing on the U.S. market on one side and solar panels manufacturing on the other side.”

“We invested in SunPower nearly ten years ago next Spring and our partnership has come far,” said Patrick Pouyanne, chairman of the board and CEO of Total. “Today is a significant step in our evolution. We believe the time is right for each company to start off on their own, leveraging their own strengths, with focused business plans and defined markets.”

SunPower has distributed to holders of its shares one Maxeon share for every eight SunPower shares held on close of business on Aug. 17, 2020, the record date for the spin-off. Maxeon’s ordinary shares begin trading today on NASDAQ under MAXN.