PVTIME – In January 2024, Xinyi Solar (00968.HK) announced that its polysilicon production base in Yunnan Province, China is expected to be operational in March 2024. As a leading company in the production and development of ultra-clear patterned solar glass, anti-reflective coating glass and back glass for PV modules, Xinyi Solar is shifting its business to polysilicon due to the decline in PV glass price and its profit. The new polysilicon plant was launched in December 2021, with a total investment of 20 billion yuan (US$278.4 million) to reach a production capacity of 200,000 tonnes of polysilicon. However, it does not seem optimistic to switch from photovoltaic glass to polysilicon, as polysilicon prices have fallen dramatically during 2023.

In order to slow down global warming and reduce carbon emissions regionally, China’s renewable energy industry, especially PV, has experienced fire and ice, joy and tears. On the one hand, the newly installed capacity of solar power reached 200GW in 2023, a cheerful new high. On the other hand, the entire supply chain suffered the impact of the dramatic drop in both prices and profits caused by overcapacity.

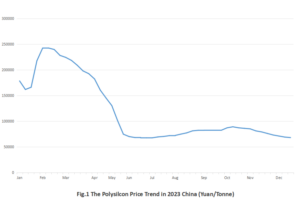

As a key link in the upstream industrial chain, the supply and price development of silicon materials has a profound impact on the entire PV industry. The price of polysilicon was volatile in 2023. Affected by the continued backlog of product inventory, the price of polysilicon fell from around 230,000 yuan / tonne in February 2023 to 60,000 yuan / tonne in June, then slightly bottomed out in July-September 2023 and rose for 12 weeks. After October 2023, polysilicon prices fell again and are currently fluctuating at a low level of around 60,000-70,000 yuan/tonne.

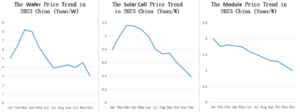

China’s solar power industry has also been affected by the fall in polysilicon prices. The year-end prices of silicon wafers, cells and modules fell sharply from the beginning of the year.

Silicon material has the largest price decline in the Chinese PV industry. In 2023, the price of monocrystalline dense material fell by 66.91%, the price of M10 wafers and G12 wafers fell by 48.66% and 38.37% respectively. While the price of p-type 182 solar cell and p-type 210 solar cell fell by 55.00% and 53.75% respectively, their modules fell by 48.01% (p-type 182 monocrystalline) and 46.45% (p-type 210 monocrystalline) respectively.

Although the ups and downs of industry chain prices are not new in the history of PV industry development, in 2023, the impact of the sharp decline in industry chain prices is triggering a new round of competition among manufacturers and drastic changes.

The decline in silicon prices is a major challenge for most silicon manufacturers. In the period from late 2020 to early 2021, only 5 of the original 20 global producers have been able to withstand the severe restructuring seen in the previous downturn cycle, which is one of the main factors behind the subsequent rise in silicon prices. Despite the cost advantage enjoyed by the notable companies, the prolonged low cost of silicon has led to a gradual decline in both revenues and profits.

The price decline in China in 2023 had been predicted by many experts in 2022, but it was not expected to be so crazy, especially in the first half of 2023.

2023 was now seen as a crucial year of overcapacity. The sharp fall in prices was mainly due to the large expansion of polysilicon production. Public data shows that the output volume of polysilicon reached 1.475 million tonnes by the end of 2023, representing a year-on-year growth of 80%, far exceeding the 68% growth of downstream silicon wafer production in the same period. the year 2023 was now viewed as the first year of overcapacity after a continuous of capacity expansion from 2021 to 2023 in China.

The expansion was driven by demand and profit. The market demand was increasing rapidly with a growth rate of 50% to 60% of newly installed demand on PV power since 2021, and that hit a record high around 70% in 2023. To meet the demand, production capacity could be increased in relatively short time in the middle and lower end of the supply chain, such as three to five months for completing a wafer or silicon ingot production base with high-intelligent equipment. However, polysilicon production requires more than a year to build up a new facility and reach operational. The production capacity of polysilicon somewhat unable to keep up with the rapid growth of the market demand, which means the polysilicon production capacity usually lag behind the demands for nearly a year. When the polysilicon production catches up, overcapacity occurs. In 2023, the capacity was more than 2 million tonnes, which was more than demand as the monthly output could reach 167,000 to 190,000 tonnes in fully operation in China to meet more than 800GW PV installed capacity demand, and it was more than the global solar power market demand of 500GW for 2023 according to PV institutions predicted.

The price of silicon material was stable at 60,000 yuan / tonne – 70,000 yuan / tonne in the forth quarter of 2023 as most of the intensive expansion of silicon material production operational. Will it keep falling or raise again?

It is estimated that the price won’t fall below 60,000 yuan / tonne in the next quarter, as the price is very close to the cost of most Chinese silicon material producers. By the end of 2023, everyone is controlling their inventories at a reasonable level. Meanwhile, low prices and profits have stopped most new projects. Only a small number of new production lines are operational.

60,000 yuan / tonne is viewed as the bottom, because the output volume of silicon material matched the demand in China in 2023. The annul output of 1.47 million tonnes of silicon material plus more than 60,000 tonnes of imported silicon, the total supply of silicon material of the market was about 1.53 million tonnes, which could be used to produce solar wafers of about 600GW. This is somewhat close to the actual silicon wafer production volume of 590GW in China in 2023.

And polysilicon prices is expected to remain stable, and won’t plummet if buyers and sellers are relatively rational. In order to maintain a healthy development of the solar power industry, both sides need to be rational. And a stable development is significant for the global photovoltaic industry, which will change from a high-growth industry to a slower-growth and mature industry.

Slowdown in polysilicon industry expansion epitomises global PV industry. The global PV industry will be transformed by 2024, characterised by slower growth, according to Wood Mackenzie. According to the report, the global PV market is still many times larger than it was just a few years ago, but slower growth is a natural scenario as the industry matures, and PV system developers will need to be more diligent and focused than ever in this new era of growth in installed PV system capacity. Competition among suppliers will intensify and efficiency improvements will be critical to maintaining profitability.

There is not much surplus silicon in 2023, but overcapacity will be evident by 2024. There are at least 13 silicon production projects under construction in China that will be operational in 2024, with a combined capacity of 1.52 million tonnes. Once completed, the total production capacity of silicon materials in China is estimated to reach 3.68 million tonnes by the end of 2024. Even if some of the production lines are closed due to poor management or competitiveness, the total production capacity is expected to reach 3 million tonnes in 2024.

However, 1.5 million tonnes of silicon material will be sufficient for the planned installed capacity of solar power projects in 2024. The current production capacity of silicon will definitely be surplus by 2024. And for 2025, even if there is no expansion, the total production capacity of silicon material is expected to be around 3.68 million tonnes. Some of the players may have to shut down their plants due to high costs and low profits. There will still be at least 3 million tonnes of capacity in 2025, capable of producing 1,200GW of silicon wafers, which is obviously superfluous for the market.

In January 2024, there are 17 polysilicon producers operating normally in China, with less new capacity being added than expected. Currently, the polysilicon market is experiencing an imbalance between supply and demand, with some projects under construction or at risk of being suspended. However, in the long term, oversupply does not necessarily have a negative impact on the development of the industry.

It is predicted that a new balance between supply and demand will be established in 2024, with polysilicon prices bottoming out and profits for high-grade silicon materials, especially polysilicon, increasing. Meanwhile, some producers unable to meet market demand, especially those with poor quality or cost control, will have to exit the market. The market will be restructured in 2024. To survive the harsh winter with many risks, including rising raw material costs and increased competition in international markets, silicon producers need to innovate in technology, improve productivity, optimise production processes and reduce production costs.

Notably, some silicon producers are able to maintain profits even though prices have fallen. Tongwei (00438.SH), a top silicon material maker in China, said in its half-yearly report in 2023 that its polysilicon production costs were controlled to less than 40,000 yuan per tonne. Daqo (688303.SH), had a cash cost of 41,620 yuan per tonne, or a cost of 47,770 yuan per tonne including sales and shipping costs. And GCL (3800.HK)’s latest cost data for granular silicon was around 35,680 yuan per tonne at its Leshan base in July 2023. These leading producers are able to continuously upgrade technology and rationally plan production capacity, which bodes well for them to maintain a favourable position in the future market.

The overall outlook for profitability therefore remains positive, despite the challenges posed to silicon companies by volatile silicon prices.

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES

Scan the QR code to follow PVTIME official account on Wechat for latest news on PV+ES